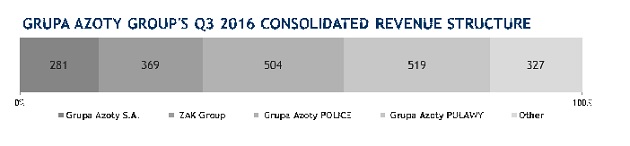

For 2016 YTD, Grupa Azoty posted revenue of PLN 6.6bn vs PLN 7.5bn the year before, with net profit of PLN 346m (PLN 540m in Q1−Q3 2015), and EBITDA of PLN 826m vs PLN 1bn for the corresponding period of the previous year. For the third quarter of 2016, Grupa Azoty reported revenue of PLN 2bn (vs PLN 2.4bn in Q3 2015), with net profit of -PLN 10m (compared with PLN 82m in Q3 2015). EBITDA for Q3 2016 came in at PLN 131m, against PLN 223m in Q3 2015. The results reported by Grupa Azoty are in line with analyst consensus expectations.

“For several months now, we have been seeing major shifts in global fertilizer prices, which reflect broader trends on the agricultural market and the markets of key raw materials for fertilizer production. Faced with this challenging market environment, we continue to ensure that Grupa Azoty delivers optimum margins. Compared with the performance of leading peers, changes in our reported results show that we outperform the competition and are able to comfortably achieve our investment objectives despite the downturn,” said Paweł Łapiński, Vice President of the Grupa Azoty Management Board.

As usual, Q3 marked the beginning of the fertilizer application season for the Agro segment, as best demonstrated by trends in the quoted prices of key traded products. Visible signs of market saturation, especially the export market, combined with the persistently low prices of agricultural produce (wheat), pushed down the prices of urea and nitrate fertilizers, with premium on gas and energy commodities only partly making up for the margin erosion. In consequence, the EBITDA margin came in at 13% (vs 16% in the previous year).

The Plastics segment continued to struggle against a very strong price pressure from customers. The sector is gradually taking steps to reduce the supply of caprolactam on the European market in the long term, by which the market shows the direction of changes seeking to optimise existing capacities. Given the solid volume of demand from the automotive market as well as the construction, textile, and food (packagings) industries, unfavourable margin trends for the entire sector should reverse in the long term.

The Chemicals segment’s clear improvement in performance and profitability was driven primarily by continued high-margin sales of melamine (as part of the flexible urea management policy), supported by the performance of Grupa Azoty Police’s OXO and pigments segments.

Grupa Azoty Puławy Group’s consolidated results

In Q3 2016, Grupa Azoty Puławy earned a net profit of PLN 16m (PLN 65m in Q3 2015), on revenue of PLN 712m (vs PLN 935m in Q3 2015).

Grupa Azoty Police Group’s consolidated results

In Q3 2016, Grupa Azoty Police, after the effect of one-off items concerning its subsidiary AFRIG S.A., earned a net profit of -PLN 9m (PLN 15m in Q3 2015), on revenue of PLN 549m (vs PLN 600m in Q3 2015).

Grupa Azoty Zakłady Azotowe Kędzierzyn’s separate results

On a separate basis, Grupa Azoty ZAK earned a net profit of -PLN 2.7m in Q3 2016 (Q3 2015: PLN 14m), on revenue of PLN 379m (Q3 2015: PLN 435m).